Business and organisation

Interogo Holding group is a foundation-owned international investment business with its parent company in Switzerland. Our purpose is to support our owner, Interogo Foundation, to safeguard the IKEA Concept, which is anchored the IKEA vision: To create a better everyday life for the many people.

We believe that long-term sustainable competitiveness can only be achieved when businesses create value both for their owners and for other stakeholders, including co-workers, society and the environment.

Read about our investment approach

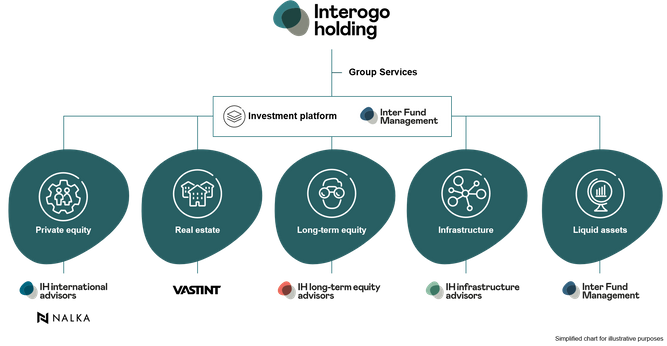

Interogo Holding’s business model is decentralised with each business area having a far-reaching responsibility for its own operations.

How we are organised

Our investment strategies include private and long-term equity, real estate, infrastructure and liquid assets.

- Private equity: we invest globally in the private equity market directly and through funds, secondaries and co-investments.

Learn more - Real estate: we invest in European real estate markets by focusing on developing and managing assets in the commercial, residential and hotel segments.

Learn more - Long-term equity: we acquire significant equity holdings in profitable and sustainable European companies. The strategy includes listed, soon-to-be listed and private companies.

Learn more - Infrastructure: we acquire holdings in infrastructure companies that are recession resilient and have stable cash-flows.

Learn more - Liquid assets: we invest globally in a portfolio of listed securities, mainly equities and fixed income.

Learn more

Interogo Holding’s operational structure is built around Inter Fund Management* (“IFM”) as investment platform, an Alternative Investment Fund Manager, authorized and regulated by the Commission de Surveillance du Secteur Financier ('CSSF').

The investment advisory teams, IH International Advisors, IH Long-Term Equity Advisors, IH Infrastructure Advisors and Nalka Advisors Germany all operate as advisors to IFM, and perform deal origination, investment due diligence, investment recommendations and investment monitoring. Our liquid asset strategy is managed by a dedicated team within IFM. Nalka Invest’s Nordic strategy and Vastint manage their investments and assets directly and are not integrated in the investment platform